Buying a home is a big financial decision, and one of the first questions you’ll need to answer is how much you can borrow for your home loan in Malaysia.

The amount you can borrow for a home in Malaysia depends on several factors, including your income, existing debts, credit score, and the bank’s policies. Most banks use the Debt Service Ratio (DSR) to assess your eligibility, which is the percentage of your monthly income that goes toward repaying debts.

A lower DSR means you can borrow more.

Key Factors:

- Income: Your monthly income is one of the biggest factors in determining how much you can borrow.

- Existing Debts: Banks will consider any existing loans or debt commitments.

- Credit Score: A higher credit score improves your chances of securing a larger loan.

- Loan Tenure: The length of your loan affects your monthly repayments and the total loan amount you can borrow.

How Much Can You Borrow?

- Income of RM 5,000/month: Up to RM 250,000 loan

- Income of RM 10,000/month: Up to RM 500,000 loan

Tip: Use online home loan calculators for a more accurate estimate based on your specific financial situation.

For a more accurate estimate based on your specific situation, visit houseloancalculatormalaysia.online and use our home loan calculator.

Factors Affecting Your Home Loan Eligibility in Malaysia

1. Debt Service Ratio (DSR)

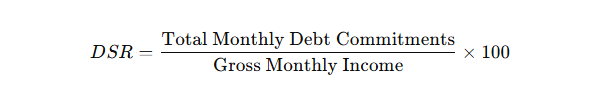

The Debt Service Ratio (DSR) is one of the most important factors that banks use to determine how much you can borrow. The DSR measures the percentage of your income that goes toward servicing all your debts, including the new home loan. A lower DSR means that you have a higher capacity to manage debt, thus allowing you to borrow more.

- Ideal DSR: Most Malaysian banks prefer a DSR below 60%. However, some may approve loans with a higher DSR, depending on other financial factors.

2. Monthly Income

Your monthly income plays a crucial role in determining the loan amount you are eligible for. Generally, banks approve home loans up to 4 to 5 times your annual income. The higher your income, the higher the loan amount you may qualify for.

3. Existing Financial Commitments

Banks take into account any existing debts you have, such as car loans, credit card payments, and personal loans. The higher your existing monthly financial commitments, the lower the home loan amount you may be eligible for. This is because banks want to ensure that you can afford to repay both your existing debts and your new home loan.

4. Credit Score

Your credit score reflects your ability to repay past debts and is used to assess your reliability as a borrower. A higher credit score will give you a better chance of securing a larger loan with a favorable interest rate. It’s essential to maintain a good credit history by paying bills on time and managing your debt effectively.

5. Property Type and Location

The value and location of the property you’re purchasing also influence the loan amount. Properties in prime locations like Kuala Lumpur or Penang may be eligible for larger loans due to their higher market value.

How Much Can You Borrow for a Home Loan in Malaysia?

Based on the factors above, here’s an estimate of how much loan you can get, based on your monthly income:

| Monthly Income (RM) | Estimated Maximum Loan (RM) |

|---|---|

| 5,000 | 250,000 |

| 7,000 | 350,000 |

| 10,000 | 500,000 |

Note: These figures are based on general guidelines and may vary depending on the bank’s policies and individual circumstances.

How to Calculate Your Loan Eligibility

To estimate how much loan you can borrow, follow these steps:

1. Calculate Your Debt Service Ratio (DSR)

DSR is a key factor used by banks to determine your borrowing capacity. To calculate your DSR, use this formula: DSR=Total Monthly Debt Commitments / Gross Monthly Income×100

- A lower DSR means you can borrow more.

2. Use Online Loan Calculators

Several online loan eligibility calculators can help you get an estimate of your loan eligibility based on your income and debts. Simply enter your monthly income, existing debt commitments, and loan tenure to see the estimated loan amount you qualify for.

Steps to Improve Your Loan Eligibility

If you want to increase your chances of getting a larger loan, consider these tips:

1. Reduce Existing Debts

Paying off car loans, credit cards, or personal loans can lower your DSR and improve your eligibility.

2. Increase Your Monthly Income

If possible, increase your income by taking on additional work or exploring other sources of income. A higher income boosts your loan eligibility.

3. Improve Your Credit Score

A higher credit score can help you qualify for a larger loan and better interest rates. Ensure timely payments and reduce any outstanding debts.

4. Make a Larger Down Payment

The more you can put down as a down payment, the less you need to borrow, which can improve your chances of securing a larger loan.

Fredrick is the creator behind houseloancalculatormalaysia.online, dedicated to helping Malaysians easily understand and calculate their home loan payments. With a focus on accuracy and simplicity, Fredrick develops reliable tools and clear guides to empower users to make informed financial decisions. His goal is to provide trustworthy, user-friendly resources that save time and reduce confusion in the complex world of home loans.