Buying a home is one of the biggest financial commitments you’ll ever make. But before you dive into homeownership, it’s crucial to understand how much your monthly repayments will be. Whether you’re a first-time buyer or looking to refinance, knowing how to calculate your home loan repayment is essential to ensure that it fits comfortably within your budget.

In Malaysia, home loan repayments are typically calculated using an easy-to-follow formula, but several factors—like interest rates, loan tenure, and the principal amount—can impact the final repayment figure. So, how do you figure out what you’ll owe each month? This guide breaks it down step by step, making the process simple and straightforward, so you can make the best decision for your financial future.

Ready to find out how much you’ll pay every month? Let’s dive into the essentials of home loan repayment calculations, and get you one step closer to your dream home!

What is a Monthly Home Loan Repayment?

A monthly home loan repayment is the fixed amount you need to pay to the bank each month to repay the amount you’ve borrowed. It consists of two main components:

- Principal: The original amount of money you borrowed.

- Interest: The cost you pay for borrowing the money from the bank.

In Malaysia, most home loans follow the amortization method, which means the repayments are fixed over time. The formula for calculating the repayment depends on your loan amount, interest rate, and loan tenure.

How to Calculate Monthly Repayments for Home Loans in Malaysia

To calculate the monthly repayment for your home loan, you can use the Amortization Formula. Here’s the step-by-step process:

Step 1: Gather Your Loan Details

You will need the following details to start the calculation:

- Loan Principal (P): The total amount you are borrowing from the bank.

- Interest Rate (r): The annual interest rate on your loan.

- Loan Tenure (n): The number of years over which you’ll repay the loan.

For example, if you are borrowing RM 450,000 with a 4% annual interest rate over 25 years, you’ll need to apply these values into the formula.

Step 2: Apply the Amortization Formula

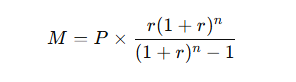

The amortization formula for calculating the monthly repayment is:

M=P×r(1+r)n / (1+r)n−1

Where:

- M = Monthly repayment

- P = Loan principal (the amount you borrow)

- r = Monthly interest rate (annual rate ÷ 12)

- n = Loan tenure in months (loan term in years × 12)

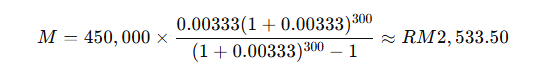

Step 3: Convert Your Interest Rate and Loan Tenure

If your annual interest rate is 4%, divide it by 12 to get the monthly interest rate:

r=4%12=0.00333

For a loan tenure of 25 years: n=25×12=300

Step 4: Plug the Values into the Formula

Let’s plug the values into the formula:

M=450,000×0.00333(1+0.00333)300(1+0.00333)300−1

When you calculate this, the result is approximately RM 2,533.50.

Example: Monthly Repayment Calculation

| Loan Amount (RM) | Interest Rate (%) | Tenure (Years) | Monthly Repayment (RM) |

|---|---|---|---|

| 450,000 | 4% | 25 | 2,533.50 |

| 300,000 | 3.5% | 20 | 1,717.92 |

| 600,000 | 5% | 30 | 3,221.48 |

Key Factors That Affect Your Monthly Repayments

While the above formula provides a solid estimate, here are a few key factors that can affect your monthly repayment:

1. Interest Rate Type

- Fixed-rate loan: Your monthly repayments stay the same for the entire loan period.

- Variable-rate loan: Your repayments may change if the interest rate fluctuates.

2. Loan Tenure

- A shorter loan tenure means higher monthly repayments but lower total interest over the life of the loan.

- A longer loan tenure lowers the monthly repayment but increases the total interest paid.

3. Bank Fees and Other Costs

- Some banks charge additional processing fees or include insurance premiums in the loan repayment amount, which can increase your monthly payment.

4. Down Payment

- A larger down payment reduces the loan principal, which in turn reduces your monthly repayments.

5. Loan Amount

- The larger the loan, the higher the monthly repayment. Reducing the loan amount by making a larger down payment will result in a lower monthly repayment.

How to Use an Online Home Loan Calculator

If you want a quick estimate without doing the math manually, use an online home loan calculator. Simply enter:

- The loan amount you want to borrow

- The interest rate offered by your bank

- The loan tenure (in years or months)

The calculator will instantly give you your estimated monthly repayment. It’s a great tool for comparing different loan offers or determining what you can afford before applying for a loan.

Why Is It Important to Calculate Your Monthly Repayments?

Understanding your monthly repayment is crucial because it helps you:

- Budget effectively: Knowing your monthly repayment will help you plan your finances and avoid overspending.

- Understand loan affordability: By calculating your repayment, you can figure out how much you can afford to borrow.

- Avoid surprises: Knowing exactly how much you’ll pay every month ensures you won’t be caught off guard by unexpected financial burdens.

Conclusion

Calculating your monthly repayment for a home loan in Malaysia is vital for making informed decisions about your mortgage. By understanding the amortization formula and considering key factors like interest rates, loan tenure, and additional costs, you can accurately estimate your repayments and make sure your loan fits within your budget.

If you’re ready to move forward with your home loan, use an online calculator to get a quick estimate, or consult with your bank for the most accurate repayment figures. With the right information, you can confidently plan for your new home and ensure that your mortgage is manageable.

FAQs About Home Loan Repayments in Malaysia

1. Can I change the loan tenure after signing the agreement?

- Yes, many banks offer flexibility in adjusting the loan tenure during the loan period. However, the change may affect your monthly repayment amount.

2. What happens if I can’t make a monthly repayment?

- Missing payments can result in late fees or even penalties. It’s essential to contact your bank immediately if you face financial difficulties.

3. How can I lower my monthly repayments?

- You can lower your repayments by opting for a longer loan tenure, increasing your down payment, or refinancing to a loan with a lower interest rate.

Fredrick is the creator behind houseloancalculatormalaysia.online, dedicated to helping Malaysians easily understand and calculate their home loan payments. With a focus on accuracy and simplicity, Fredrick develops reliable tools and clear guides to empower users to make informed financial decisions. His goal is to provide trustworthy, user-friendly resources that save time and reduce confusion in the complex world of home loans.